Licenses & Registrations

In order to ensure the provision of their portfolio of services in full compliance with all applicable global and local regulations and standards, the LIQD companies hold licenses and registrations in EU jurisdictions to bring our operations in line with newly adopted legislative changes.

LITHUANIA

Financial Crime Investigation Service

Registration as Virtual Currency Exchange Operator

COMPANY

LIQD Services UAB

What does LIQD being

Licensed and Regulated mean?

What We Need To Provide

What We Need To Provide

What We Need To Provide

Adequate operational capital

a) We are subject to the minimum initial capital and own funds requirement. Own capital requirement is intended for covering the risk of a provision of payment services.

b) We protect your funds with our security measures (segregation of funds and funds insurance).

Your payouts are protected as entrusted to a company with adequate operating capital.

Internal and external auditor is mandatory

Our accounts are subject to additional check.

Four layers of defense for your business.

Sound Anti-money laundering (AML) policies and procedures

a) Risk-based approach (RBA) in assessing and managing the money laundering and terrorist financing risk to the company.

b) We perform customer due diligence (CDD), identification and verification procedures, including enhanced due diligence, screening against UN, EU, OFAC sanction lists.

Our AML/CTF policies and procedures make us reliable partner within the financial sector safeguarding our own and your business reputation.

Data protection and security

We maintain high level IT security checks and data protection processes, access right procedures and data encryption.

Your sensitive information is safe and protected with us.

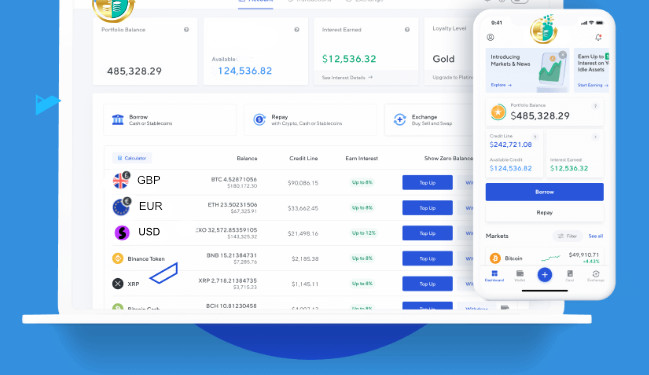

Unleash the Power of Your Savings

With the account that caters to your profit and prosperity through our leading credit line service for assets and high-yield interest on your idle savings.